Canada’s Inland Revenue and Postal War Tax Stamps

did not Finance its War Expenditures during the First World War

Christopher D. Ryan

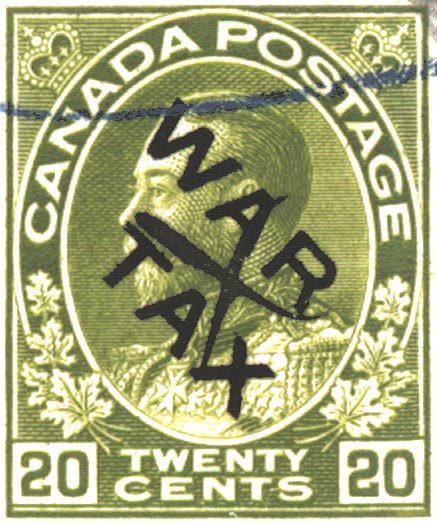

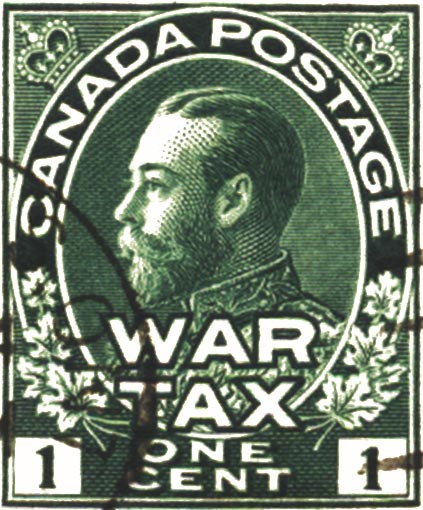

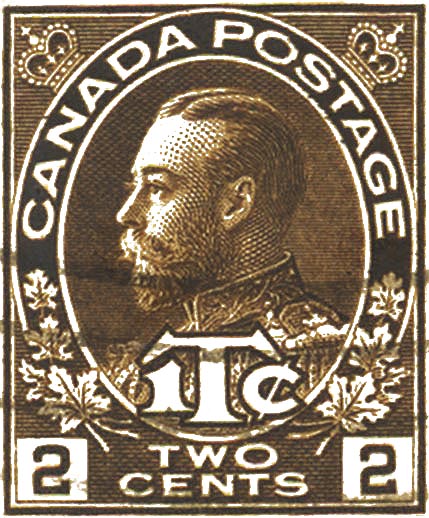

Canada’s postal war tax stamps of 1915-1918 are neither revenue nor semi-postal stamps; they are postage stamps. The so-called “war tax” on postal matter was a “tax” in its name only. In practice, it was simply an increase in the postage rates cloaked in a patriotic guise. There was no separate accounting for the money raised by the “postal war tax.” All the funds went into general postal revenue and financed the operations of the Post Office. The money from the “postal war tax” did not finance the war effort of 1914-1918.

Similarly, the funds raised by the Inland Revenue “war taxes” did not finance the war effort. In 1915, these taxes included levies on banks, trust and loan companies, insurance companies, railway and steamship tickets, telegrams, cheques, wine, etc., only some of which were paid by stamps. Their purpose was to replace Customs revenue lost as a result of the wartime reduction in international trade.

Unlike the Second World War where a “pay-as-you-go” policy was followed as much as possible, Canada’s philosophy during the First World War of 1914-1918 was to finance its military expenditures by borrowing, and, to a lesser extent, by expanding its money supply. At the time, federal government revenues came primarily from customs and excise duties and the Minister of Finance, W. Thomas White, was opposed to significant new taxation to pay for the War. His reasons included the lack of the organizational infrastructure required for the large-scale introduction of direct taxes, the intrusion into fields already being taxed provincially, the opinion that high taxes would suppress economic activity, and a belief that the cost of the conflict should be shared with future generations.

In 1915, Minister White kept the new taxes “to the minimum amount regarded by the Government as necessary”, and claimed to have targeted them “at those members of the community who are best able to sustain it”. Relative to the amounts spent on the War, the amounts raised by the various Inland Revenue “war taxes” during 1915-1920 were small, and were consumed by regular expenditures. Even near the end of the conflict when the Income Tax and additional “war excise taxes” were introduced, the amounts raised went entirely towards regular expenditures as well as interest and charges on the immense war debt (see Tables 1 and 2).

At the 1915 introduction of the “war taxes”, objections to their title were made both in and out of the House of Commons, a title that the Government defended.

► The Opposition (J.G. Turriff):

The Minister of Finance tells the House and the country that a part of this taxation that he proposes to put on is a war tax – that it is a tax to help out the war. I say this Government is deliberately making an attempt to get money from the people under false pretenses. Not a dollar of what the minister proposes to raise by direct taxation or by the increased tariff duties is for the purposes of the war. I give the Minister of Finance and the members of the Government generally credit for this – that they have made the people of Canada to a certain extent believe that this money is for the war. But I can tell them that, when the people of Canada realize that there is not a word of truth in the representations that they have made on this subject, when they realize that the Minister of Finance is borrowing all the money for the war and that all he has collected by taxation is to enable the Government to continue its course of reckless extravagance, the Government will not last five minutes after that question has been fairly submitted to a vote of the people.

It takes a good deal of work, a good deal of explanation by the newspapers and public men to get the facts home to the people. But they will learn it. They will learn that the increased taxation is raising the cost of living, and God knows it was high enough. But it is going to be higher because this Government taxes practically everything the poor man eats or wears. The people will understand that before long, because each man will feel it in his pocket. Every time a postcard is mailed there is a special tax of one cent – the cost is doubled. Every time a letter is mailed, a stamp printed “war tax” must be put on at the cost of an additional cent. I wonder at the Government having the nerve to call this a war tax when they know it is nothing of the kind.

(Debates, 1915, pp. 420-421.)

► The Government (A.C. Macdonell):

My hon. friend denies that this is a war tax, but I submit that this a war tax, if there ever was one. They are made necessary by the war, whether the proceeds are used to buy guns and war material or to make good revenue deficits caused by dislocation of trade and consequent loss of revenue. The war has closed off borrowing by Canadian corporations, thereby diminishing imports.

The new taxes will pay interest on war loans, pensions, and part of capital expenditure. The interest on the $50,000,000 to be borrowed this year and the $100,000,000 to be borrowed next year will amount to nearly $7,500,000 annually. This the new taxes will have to provide for, together with interest on additional borrowings during the war. It must also provide for a pension list amounting to about $4,000,000 or $5,000,000 a year. If there were no war the Government could borrow money in the London market under the usual conditions, but, as I have attempted to show, the war makes that impossible.

(Debates, 1915, pp. 372-373.)

► The Government (W.T. White):

The reason why we are calling this a war tax is this: the country is at war; revenues are diminished, and we are required to find money to meet, in addition to the ordinary expenditure required to carry on the affairs of the country, the interest upon the debt which we shall incur in borrowing for the purposes of our participation in the war. In addition to that there will be pension charges upon the Government.

But, putting this all aside, I desire to say now, without the slightest intention of stirring up any discussion in the matter, that even if not a dollar of the money would go for the specific purposes of the war – that is to say, be ear-marked and specifically applied to some purpose immediately connected with the war – the tax would still be purely a war tax, because the only reason for its imposition is that the country is at war and that the normal revenues are not sufficient to meet the abnormal strain which is upon us.

(Debates, 1915, pp. 1206-1207.)

This dispute over the title of the taxes was discussed by Oscar D. Skelton of Queen’s University as part of a July 1915 essay:

There has been much discussion in party newspapers as to whether these new taxes are properly termed ‘war taxes’. If by war taxes we mean taxes imposed during war, or taxes made necessary, in whole or in part, by the effect of war on revenue, the new Canadian taxes are certainly war taxes, just as are the stamp taxes recently adopted in the United States. If the term means taxes imposed to meet the expenses of the war, its applicability is a matter of individual choice. The plain facts are that, with the new taxes, total revenues fall short of meeting expenditures other than for war by sixty millions in 1914-15 and fifty in 1915-16, and that this deficit as well as the whole war expenditure is met by borrowing.

(Federal Finance, p. 15)

Thus, the Inland Revenue “war tax” stamps represented taxes because of war – a reduction in Customs revenue – and not taxes for war, while the postal “war tax” stamps were postage stamps. Starting with the budget of May 1920, the labels “war tax” of 1915 and “war excise tax” of 1918 were dropped in favour of the new designation of “excise tax”.

Table 1: Federal “War Tax” and Total Revenue, Fiscal Years 1916 through 1920 (millions CDN$)

| Fiscal Year ended 31 March | 1916 | 1917 | 1918 | 1919 | 1920 |

|---|---|---|---|---|---|

|

Inland Revenue War Tax Stamps Sold by Collectors of Inland Revenue – Amount and Percent of Total Revenue |

$0.755 (0.44%) |

$0.900 (0.39%) |

$1.034 (0.40%) |

$2.813 † (0.90%) |

$4.133 † (1.18%) |

|

Other War Taxes‡ of 1915 and 1918 collected

by the Inland Revenue Dept. and the Finance Dept. |

$2.837 |

$2.901 (includes embossed stamps) |

$3.088 (includes embossed stamps) |

$11.072 † (includes embossed stamps) |

$13.118 |

| Embossed Stamps on Cheques, Drafts, etc. | $0.028 ¶ | $0.439 ¶ | |||

| Business Profits Tax of 1916 | — | $12.5 | $21.3 | $33.0 | $44.1 |

| Income Tax of 1917 | — | — | — | $9.35 § | $20.3 |

|

Total Revenue from All Taxes and Fees, Including Post Office Revenue |

$172.1 | $232.7 | $260.8 | $312.9 | $349.7 |

(Sources: Canada, Auditor General’s Reports, Inland Revenue Reports, Public Accounts, as published in Sessional Papers.)

† On 1 May 1918, stamp taxes were imposed on matches and playing cards. The new tax on matches comprised 54.6% of the total amount of stamp taxes collected in the fiscal year ended 31 March 1919. In addition, non-stamp war taxes were levied on tea, jewellery, automobiles, and other goods. In 1918-19, the new tax on automobiles comprised 34.2% of the total amount collected under the heading of “other war taxes.”

‡ These figures do not include the additional Customs Duty of 5% or 7½%, which is buried in Customs revenue. The Finance Dept. collected the taxes on banks, insurance, trust and loan companies, as well as on incomes and profits.

¶ The tax represented by the embossed stamps was paid to the central Inland Revenue office in Ottawa.

§ Collected in the Fiscal Year 1918-19 for the Taxation Year 1917.

Table 2: Federal Receipts (+) and Payments (−), Fiscal Years 1916 through 1920 (millions CDN$)

| Fiscal Year ended 31 March | 1916 | 1917 | 1918 | 1919 | 1920 | |

|---|---|---|---|---|---|---|

|

Total Revenue from All Taxes and Fees, Including Post Office Revenue |

+$172.1 | +$232.7 | +$260.8 | +$312.9 | +$349.7 | |

| Money Borrowed | Net | +$225.9 | +$433.2 | +$424.2 | +$774.0 | +$624.2 |

| General Expenditures – Ordinary, Capital and Misc. | -$146.4 | -$138.7 | -$170.6 | -$178.9 | -$266.5 | |

| Interest & Other Charges on the Public Debt | † | -$25.3 | -$51.1 | -$58.8 | -$76.7 | -$126.9 |

| Investments Bought for Sinking Fund | -$1.77 | -$1.47 | -$3.18 | -$1.45 | -$3.67 | |

| Other Investments | Net | +$1.78 | −$38.6 | −$90.2 | −$71.7 | −$177.9 |

| Savings Banks | Net | −$0.473 | +$2.69 | −$2.86 | −$0.303 | −$10.7 |

| Dominion Notes | Net | +$20.9 | +$5.31 | +$67.5 | +$38.5 | +$22.7 |

| Trust Funds | Net | −$0.193 | +$0.463 | +$0.841 | +$0.646 | +$1.67 |

| Miscellaneous Accounts and Funds | Net | −$34.0 | −$122.6 | +$39.5 | −$371.6 ‡ | −$60.0 |

| Cash Accounts – Canada, London, New York | Net | −$19.9 | −$17.9 | −$121.5 | +$16.3 | −$23.1 |

| Specie Reserve | Net | −$26.4 | +$2.46 | −$1.59 | −$1.81 | +$17.2 |

| Refund of Management Charges on Loan Account | — | — | — | +$7.48 | — | |

| War Expenditures | −$166.2 | −$306.5 | −$343.8 | −$446.5 | −$346.6 |

(Source: Canada, “Statements of Receipts and Payments,” Public Accounts, as published in Sessional Papers. The format of the Public Accounts was significantly altered in 1920. For that year, the statements and schedules of the “Expenditure and Revenue Account” and the “Condensed Cash Statement” were used.)

† Interest, management charges, premiums, discounts, exchange.

‡ This unusually large amount was due to $385.8 million paid to the Imperial Government (UK) and $61.9 million received therefrom for unspecified purposes.

References

- White, W.T., Minister of Finance, “The Budget: Proposed War Taxation”, Debates of the House of Commons, 1915, pp. 80-94, and debate thereon, pp. 352-387, 404-35, 789-90, 852, 885, 926, 1206-07, 1420-21; “The Budget”, Debates, 1916, pp. 807-817, and debate thereon, pp. 889-905.

- White, (W.)T., Minister of Finance. The Story of Canada’s War Finance. Montréal: 1921.

- “War Tax Imposed”, Toronto Daily Star, 11 February 1915 (evening), p. 1.

- “Wheels Work Smoothly”, Toronto Daily Star, 12 February 1915 (evening), p. 2.

- Skelton, O.D., “Federal Finance”, Bulletin of the Departments of History and Political and Economic Science in Queen’s University, Paper № 16, July 1915. (CIHM № 78649)

- Skelton, O.D., “Canadian War Finance”, The American Economic Review, December 1917, Vol. 7, № 4, pp. 816-831. (www.jstor.org/stable/1809437)

- Deutsch, J.J., “War Finance and the Canadian Economy, 1914-20”, The Canadian Journal of Economics and Political Science, November 1940, Vol. 6, № 4, pp. 525-542. (www.jstor.org/stable/136982)

- Perry, J.H., Taxes, Tariffs, & Subsides: A History of Canadian Fiscal Development. Toronto: University of Toronto Press, 1955, Vol. 1, pp. 137-165, Vol. 2, pp. 327-340.

- Campbell, C., “J.L. Ilsley and the Transformation of the Canadian Tax System: 1939-1943”, Canadian Tax Journal / Revue Fiscale Canadienne, 2013, Vol. 61, № 3, pp. 633-670.

- Ryan, C.D., “Nominal War Tax Stamps of the Canadian Post Office Department, 1915-1918”, Canadian Revenue Newsletter, December 2010, № 71, pp. 7-10.

About the author

Christopher D. Ryan is a noted researcher of BNA Revenue stamps. He has edited the Canadian Revenue Newsletter, the newsletter of the Canadian Revenue Study Group, since 1995, and was awarded the John Siverts Award for best BNAPS Study Group newsletter in 1998. He has also published extensively on the subject, and was given the Vincent G. Greene Award for best article in BNA Topics in 1994, 2000, 2005, and 2011. In 2011, he received the Research Medal of The Revenue Society. In 2013, he published the Catalogue of the Federal Tobacco Stamps of Canada which is available online in PDF format. His "An Introduction to Canadian Revenue Stamps" is posted on the BNAPS website.

Copyright © 2016 Christopher D. Ryan

Web design copyright © 2013-2026 The British North America Philatelic Society.

The documents on this website are for informational and non-commercial or personal use only.

Documents on this website shall not be used on other websites or for commercial purposes without permission.

This page was last modified on 2023-10-08