Introduction |

Airport Departure Fee Tickets |

Amusements Tax Tickets |

Assurance License Stamps |

Bill Stamps |

Chômage-Unemployment Stamps |

Consular Fee Stamps |

Customs Duty Stamps |

Electric Light or Electricity Inspection Stamps |

Excise and War Tax Stamps |

Excise Duty – Tobacco Stamps and Malt Syrup Stamps |

Garbage Tags |

Gas Inspection Stamps |

Gasoline Tax Stamps |

Hospitals Aid Stamps |

Hunting and Fishing Stamps |

Inland Revenue Stamps |

Law Stamps |

Liquor Stamps – Federal |

Luxury Tax Stamps |

Postal Note and Scrip Stamps |

Registration Stamps |

Sales Tax Tickets |

Saskatchewan Power Commission |

Search Fee |

Telegraph Franks |

Telephone Franks |

Tobacco Tax |

Transfer Tax Stamps |

Transportation Tax Stamps |

Unemployment Insurance Stamps |

Vacation Pay Credit Stamps |

War Savings and Thrift Stamps |

Weights and Measures Stamps

Introduction

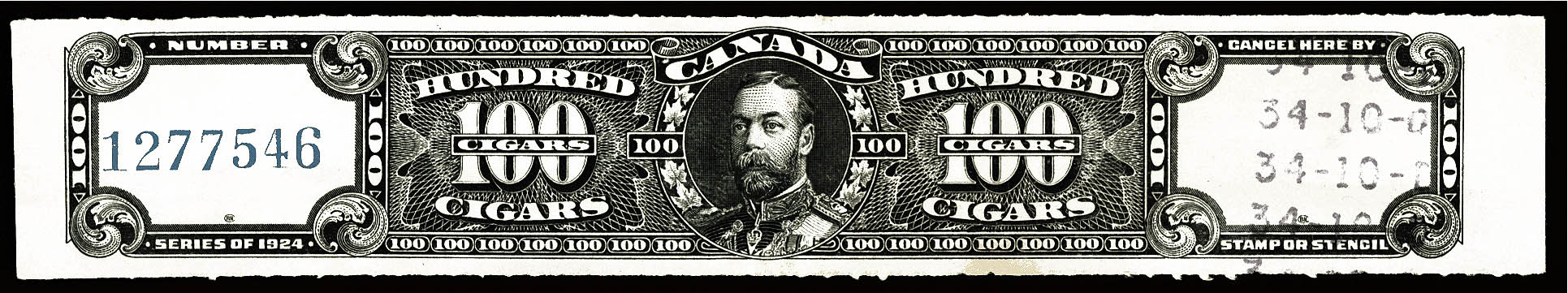

Excise Duty stamp for cigars

Revenue stamps (commonly called Revenues) are used to pay a fee, tax or credit to a governmental department, agency or authority. In addition to the traditional adhesive stamps, Revenues also take the form of imprints, embosses, tickets and printed marks applied by meter machines.

Revenues encompass a wide and diverse field. Over the years, they have been used in Canada for items as varied as court documents, sales receipts, loan statements, playing cards, matches, garbage, cheques, tobacco, liquor, deeds, cigarette papers, perfumes, licences, patent medicines, stock certificates, bills of exchange, gasoline, contracts, passports, inspection certificates, etc., etc. For many years, revenue stamps were far more numerous in this Country than postage stamps.

With a few exceptions such as paid tags for garbage and excise stamps for tobacco products, revenue stamps are not used today. However, new discoveries are still being made amongst stamps issued decades ago.

The simplest way of collecting Revenues is by face-different stamps. This can be easily expanded upon by adding perforation and shade varieties, as well as specimens and proofs. Extensions can also be made into the realms of perfins, cancels, printed precancels, margin inscriptions, lathework and stamped documents. One big field of current interest is the background history of the stamps. There is ongoing research in most of these areas.

For most Revenues, the standard numbering system is provided by van Dam’s The Canadian Revenue Stamp Catalogue. Additional details for many of the stamps can be found in Canadian Revenues (Second Edition) by Edward Zaluski. The latter item comprises PDF and HTML files on CD/DVD and updates the First Edition published in paper form from 1988 through 1994.

In the case of excise stamps for tobacco products, a new publication, Catalogue of the Federal Tobacco Stamps of Canada, was released in June 2013. It is available online as a free PDF at http://www.canadarevenuestamps.com/RyanTobaccoCatalog1side.pdf. This publication replaced the Brandom Catalogue (Second Edition) that had been in use since 1976. Updates to the new tobacco stamp catalogue can be found at the following website: https://sites.google.com/site/canadiantobaccostamps/.

An online exhibit by Terrance R. Harris, "Newfoundland Fiscal Stamps and Usages", displays the various usages of revenue stamps in Newfoundland prior to Confederation in 1949.

Most new discoveries and current research on Canadian Revenues are published in Canadian Revenue Newsletter (CRN), the newsletter of the Canadian Revenue Study Group. Many issues of CRN are available on the Canadian Revenue Study Group web page. Articles on Canadian revenues have also appeared in BNA Topics, The Revenue Journal (published in the UK) and The American Revenuer.

Descriptive Listing of Various Types of Canadian Revenue Stamps and Related Items

- Education Tax Tickets - Saskatchewan's retail sales tax.

- Electric Light or Electricity Inspection Stamps

- Excise and War Tax Stamps

- Excise Duty – Tobacco Stamps and Malt Syrup Stamps

- Health Tax - See Tobacco Tax

- Hospitals Aid Stamps

- Hospital Tax Tickets - Nova Scotia's retail sales tax.

- Hunting and Fishing Stamps

- Malt Syrup Stamps - See Excise Duty – Tobacco Stamps and Malt Syrup Stamps

- Sales Tax Tickets

- Saskatchewan Power Commission

- Saskatoon Electric Department - See Saskatchewan Power Commission

- Search Fee

- Social Security and Municipal Aid Tax Tickets - British Columbia's retail sales tax.

- Social Service and Educational Tax Tickets - New Brunswick's retail sales tax.

- Social Services Tax Tickets - British Columbia's retail sales tax.

- Ultimate Purchaser's Tax - Alberta's short-lived retail sales tax.

- Unemployment Insurance Stamps