Excise and War Tax Stamps

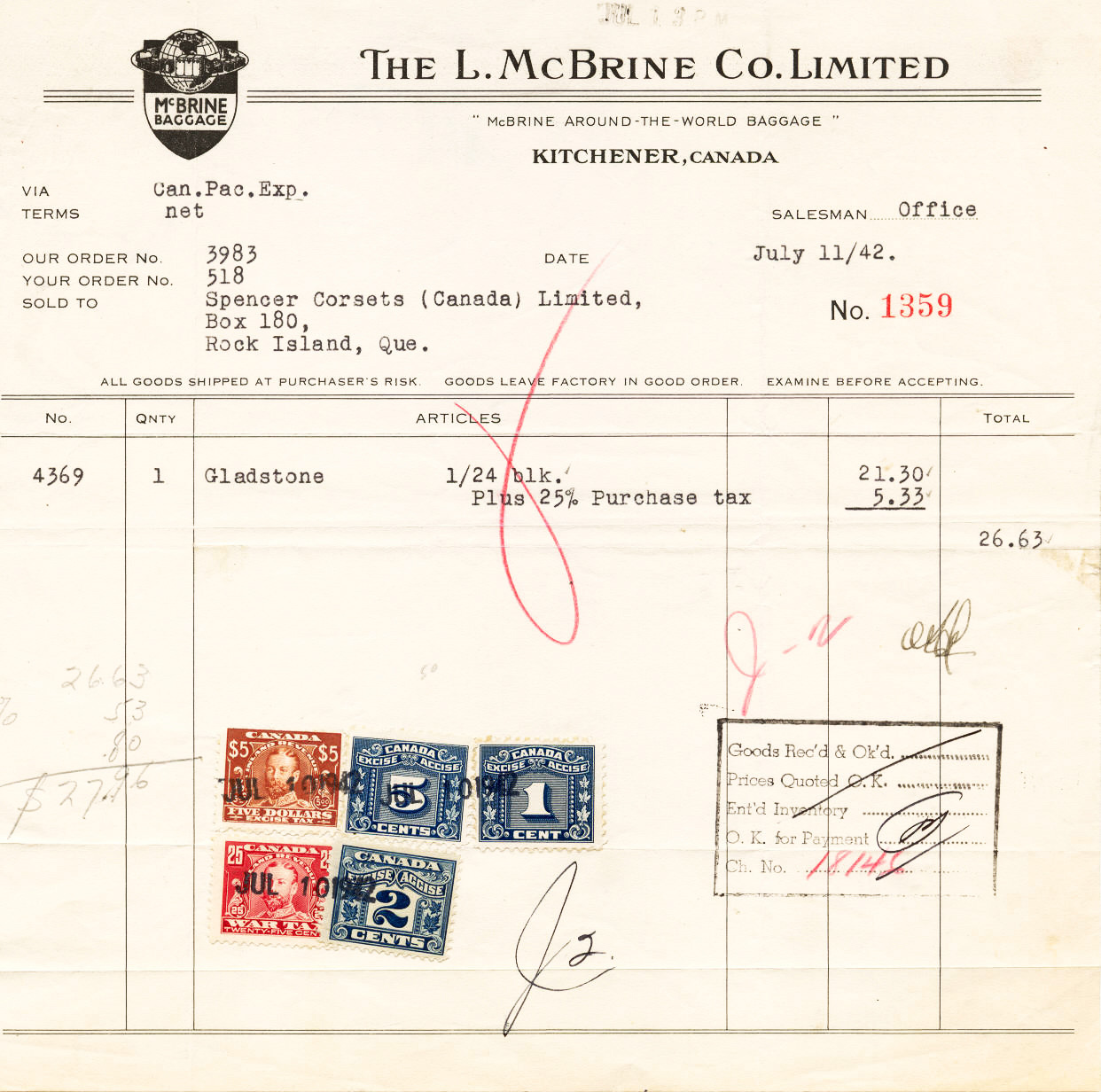

While the War and Excise Tax stamps issued by the federal Revenue Department have been traditionally catalogued as separate varieties, these issues are really all one and the same type of revenue stamp. The variations in the inscription were a result of the period in which the basic, unsurcharged stamp was issued. The chronology of the inscriptions is as follows:

| 1915 | War Tax (provisional overprint on postage stamps) |

| 1915 - 1919 | Inland Revenue - War Tax |

| 1920 - 1921 | Inland Revenue - Excise Tax |

| 1922 | Customs and Excise - Excise Tax |

| 1923 onwards | Excise - Accise |

All of these stamps, regardless of their inscription, were used to collect some of the taxes imposed under the Special War Revenue Act, which was renamed the Excise Tax Act. All but one of these stamp taxes were repealed or converted to a non-stamp tax in or before 1953.

"War Tax", "Excise Tax" and "Excise - Accise" stamps on the same document

Introduction |

Airport Departure Fee Tickets |

Amusements Tax Tickets |

Assurance License Stamps |

Bill Stamps |

Chômage-Unemployment Stamps |

Consular Fee Stamps |

Customs Duty Stamps |

Electric Light or Electricity Inspection Stamps |

Excise and War Tax Stamps |

Excise Duty – Tobacco Stamps and Malt Syrup Stamps |

Garbage Tags |

Gas Inspection Stamps |

Gasoline Tax Stamps |

Hospitals Aid Stamps |

Hunting and Fishing Stamps |

Inland Revenue Stamps |

Law Stamps |

Liquor Stamps – Federal |

Luxury Tax Stamps |

Postal Note and Scrip Stamps |

Registration Stamps |

Sales Tax Tickets |

Saskatchewan Power Commission |

Search Fee |

Telegraph Franks |

Telephone Franks |

Tobacco Tax |

Transfer Tax Stamps |

Transportation Tax Stamps |

Unemployment Insurance Stamps |

Vacation Pay Credit Stamps |

War Savings and Thrift Stamps |

Weights and Measures Stamps